The insurance industry needs to be reinvented, and there is a lot of talk about it in the Fintech community. For instance, by giving customers more options, internet rate aggregators have increased their presence in the life insurance market.

When RateHub CEO Alyssa Furtado presented her idea to CBC’s Dragons’ Den in 2016, the Canadian business tycoons Joe Mimran and Jim Treliving graciously invested an astonishing $1,000,000 in her venture.

I like the move into insurance for a few reasons, Mimran said after completing the Dragon’s Den deal at a $14,000,000 valuation. The desire of insurance companies to conduct more business online aids RateHub’s efforts to diversify further and acquire lifelong clients.

The objective will be to increase brand recognition before a rival enters the market and aggressively competes with it through marketing. The Fintech world began to realize that Insurtech might be the coming great technological advancement in personal finance services after that.

The Millennial Conundrum

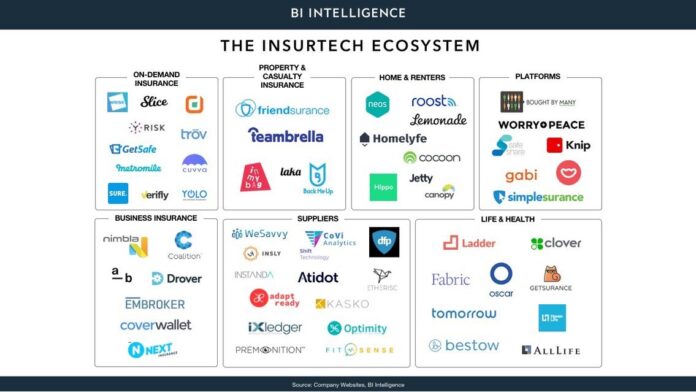

Other, less apparent players are also entering the scene. The needs of younger markets are defining how business should be conducted in the future, which is causing distribution patterns to change. These organizations want to use new technology to address a variety of problems, including antiquated application procedures, protracted decision-making processes, inconsistent underwriting, and ineffective data transfer protocols.

Insurtechs, or startups in the insurance industry, are working to reimagine the ways that insurance is distributed in a few important ways. The first group of disruptors aim to lower friction in the insurance purchasing process by facilitating consumer needs research, rate comparison, application completion, and acceptance of policy offers.

The second group of insurance startups is concentrated on helping insurers by improving internal procedures that speed up, improve accuracy, and streamline administration and underwriting.

Insurtech startups will need to demonstrate that their suggested models offer a significant benefit to insurance policyholders, the financial intermediaries who issue these policies, and the industry as a whole given how strictly regulated the P&C, Life, and Health insurance sectors are.

There are some easy wins, such getting rid of pointless paper-based procedures and giving education about the genuine coverages customers want and need priority.

The majority of insurance startups have kept their disruptive efforts to improving the front-end experience only. Recently, there has been a greater effort made to alter the fundamental operating systems of insurance carriers, providing them with a base from which to adopt cutting-edge technologies.

I’ve highlighted six cutting-edge firms that are making significant contributions to the insurance industry. This should serve as a primer for advisers who are unsure of their place in this newly evolving world.

LOGiQ3

LOGiQ3 has been operating in Canada since 2006 and is a significant player in the cutting-edge InsurTech industry. This business was founded with the goal of bringing fresh thinking to the insurance and reinsurance sectors. Utilizing technology to raise the caliber of data transmission between carriers and customers is their key objective.

The business also owns APEXA Inc., a platform for the Canadian digital life insurance market that has generated a lot of debate among advisors. The contracting and compliance requirements for advisors, managing general agents (MGAs), and insurance firms are being standardized by this software. Their solution asserts to increase process efficiency and transparency while decreasing non-compliance risks.

Additionally, LOGiQ3 is the owner of Cookhouse Lab, Toronto’s first open insurance innovation collaborative space. Leaders in the life insurance and reinsurance industries can gather at The Cookhouse Lab. To design and develop disruptive solutions with InsurTech, they collaborate and share ideas.

At Cookhouse Lab, insurance professionals can interact with one another. They can work together in 90-day sprints, developing minimal viable products through ideation, lab work, and digital acceleration.

Cookhouse Lab’s costs start at $3,000 a month at their Toronto site, so getting a seat there is not cheap. Nevertheless, the advantages depend on the possible outcomes that might be obtained. The incubator is the only one of its kind and provides access to all creative life insurance industry specialists.

Planswell

By teaching people about their needs and providing preliminary insights into their financial planning process, Planswell helps Canadian consumers save time. Consumers can now overcome the obstacles of procrastination thanks to the development of web-based financial planning solutions.

They provide advisors with a low-stress way to interact with potential insureds who might not have the time to fill out a needs analysis form in person. The tool has a simple, quick, and user-friendly layout, and it takes less than 30 minutes to complete.

The user starts the process by providing information on their income, liabilities, and lifestyle choices. The program then offers advice on registered savings plans, borrowing possibilities, and choices for life and living benefit insurance.

By considering the user’s whole financial condition before making any recommendations, Planswell functions as a true needs analysis tool. When providing solutions, bear in mind savings, spending patterns, and insurance requirements.

Humi

In 2016, Humi set out to completely reimagine how small- and medium-sized businesses used software to handle their payroll, human resources, and employee benefits. Before Humi, SMBs lacked an all-encompassing platform to control these facets of their operations.

The business began by giving all group benefits clients who were SMB clients free HR software. The offer was highly pertinent to their intended audience. This made it possible for their clients to start their engagement with access to technologies that are considered industry standard.

The processing time that is saved for clients by using the free HR software is Humi’s unique selling proposition. Humi has a definite advantage over conventional health insurance brokers thanks to this value-added service.

Their solution includes helpful features like grouping onboarding processes and automatically alerting brokers about the addition and termination of new employees. The management of group health benefits by businesses with under 1000 employees is completely revolutionized by Humi.